Home » Industry 4.0

Industry

4.0

It is simple to access the incentives of the Industry 4.0 Plan with Turri’s complete solutions!

Tax savings

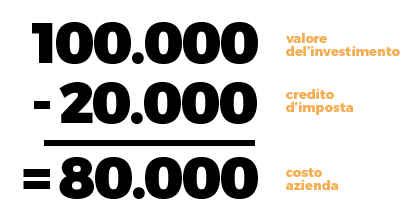

The 2024 budget law has confirmed a 20% tax credit for investments of up to €300,000 in 4.0 machinery, which you can benefit from in 3 annual installments at starting from the year of interconnection of the asset

Example:

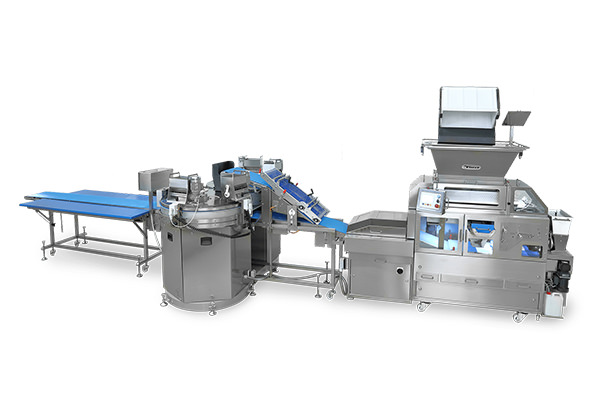

A complete range of 4.0 products

The strength of the Turri group, with the Turri, Alaska and Victus brands, allows us to offer you a complete range of 4.0 products ready for interconnection. Discover them all!

A complete range of 4.0 products

The strength of the Turri group, with the Turri, Alaska and Victus brands, allows us to offer you a complete range of 4.0 products ready for interconnection. Discover them all!

Choose your interconnection mode

How to get the benefit

1. Interconnect the asset

If you have chosen the solution with a subscription to the Turri Group web platform, interconnect the machine to your internet network. Access the platform from your PC and use our 4.0 features to monitor and interact with the machinery. If, however, you have opted for interconnection with your factory software we will provide all the information to your software developer for optimal integration. Remember that you can only take advantage of the tax benefit starting from the date of interconnection!

2. Fill in the self-certification

For investments of up to €300,000 it is sufficient to produce a self-certification from the company's legal representative declaring that the machinery complies with the 4.0 requirements. It is also recommended to draw up a technical analysis to detail how the machinery complies with the 5+2 legal requirements, to be kept and exhibited in the event of inspections by the Revenue Agency.

Have you chosen the subscription to the Turri Group web platform and do you need assistance in drafting the technical analysis? Turri has already appointed an external professional to produce a sworn report complete with technical analysis, which you can attach to your self-certification!

3. Maintain interconnection for 5 years

The interconnection requirement must be maintained by law for at least 3 years, but it is recommended to maintain the interconnection and use the related functions until at least the fifth year, the last period within which the revenue agency can carry out checks on the effective interconnection of the asset during the 3 years following the interconnection.

Rely on the 4.0 features offered by the Turri Group

Real-time monitoring

Keep the machine's operating parameters under control at all times.

Loading/unloading programs

Edit recipes remotely and send them to the machine

Operation history

Archive historical operating data.

Teleassistance

Assistance can connect remotely to quickly identify the problem and reduce machine downtime.

Alert alarms

Receive notifications in case of malfunctions wherever you are, and minimize machine downtime and product waste.

Periodic maintenance

The machine automatically warns you when it is time to carry out a check and prevent future breakages.

Can be combined with the South Bonus!

For companies with production facilities located in the regions listed below, the 4.0 tax credit can be combined with the tax for the South (“Southern Bonus”)

| Type of business | Campania, Sicily, Sardinia, Calabria, Puglia, Basilicata | Molise and Abruzzo | |

| Small | 45% | 30% | 30% span> |

| Average | 35% | 20% | |

| Large | 25% | 10% |

If for example you are a small business in Sicily, the resulting credit will be 20+45=65%, therefore arriving at a really important benefit!

Turri machines ready for Industry 4.0

Do you want to know more? Check out our frequently asked questions

?

All companies resident in Italy are eligible, including permanent organizations of non-residents, regardless of their legal form, economic sector membership, size and tax regime for determining income. companies are excluded:

- not in compliance with regulations on safety in the workplace and the correct payment of social security and welfare contributions for workers

- recipients of interdictory sanctions (article 9, paragraph 2, Legislative Decree no. 231/2001)

- in a state of voluntary liquidation, bankruptcy, compulsory administrative liquidation, composition with creditors without business continuity or other insolvency procedure provided for by bankruptcy law (Royal Decree n . 267/1942), by the Corporate Crisis and Insolvency Code (Legislative Decree no. 14/2019) or by other special laws or who have proceedings underway for the declaration of one of these situations.

The 20% rate applies to investments made with the following timescales:

- Investment concluded by 12/31/2025, or

- Order placed by on 12/31/2025 with 20% deposit payment by 12/31/2025 and delivery of the goods by 06/30/2026

Starting from the year of interconnection of the asset, in 3 annual installments of the same amount.

Absolutely yes.

Yes, in the case of leasing the tax credit can be combined with the Sabatini contribution.

Yes, it can be combined with other bonuses including South Bonus, Nuova Sabatini, Research and Development tax credit, as long as the overall incentive does not exceed 100 % of the value of the investment.

The machinery must comply with the requirements defined by Circular N.4/E of 03/30/2017 of the Revenue Agency, i.e. it must possess the following 5 mandatory points

- control by means of CNC (Computer Numerical Control) and/or PLC (Programmable Logic Controller)

- interconnection to factory IT systems with remote loading of instructions and/or part programs

- automated integration with the factory logistics system or with the supply network and/or with other machines in the production cycle

- simple and intuitive interface between man and machine

- compliance with the most recent safety, health and hygiene parameters at work

and must also possess 2 of the 3 additional requirements:

a) remote maintenance and/or remote diagnosis and/or remote control systems

b) continuous monitoring of working conditions and process parameters using appropriate sets of process drift activity sensors

c) characteristics of integration between physical machine and/or system with the modeling and/or simulation of its behavior in carrying out the process (cyber-physical system).

Yes, Turri Group machines are set up for data exchange with external systems. Please remember that interconnection to existing software requires software development, which is the responsibility of the customer

Our machines are at your disposal!

At our office you can come and try your recipes by working with a 4.0 laboratory!